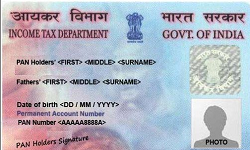

How to Submit a PAN Card Application Online?

Applying for a PAN card is an easy and trouble-free method. Pan card applications can be presented online and offline via the NSDL portal.

The Income Tax Department has authorized two important organizations in charge of furnishing PAN in the country NSDL and UTIITSL.

Local organizations are also there to collect PAN applications, prepare them, and furnish the PAN to customers.

Let’s clarify what NSDL and UTIITSL are and what kind of job they do.

Who Can Apply for PAN?

There is a large group of entities that can apply for PAN or PAN card correction/reprint requests.

These include individuals, HUFs, trusts, corporate entities, organizations, companies, local authorities, governments, minors, senior citizens, and so on.

Application Forms for PAN

There are two types of PAN card application forms 49A and 49 AA.

PAN Form 49A for Indian citizens and PAN Form 49 AA for foreigners.

Applications for new PAN or correction/reprint of PAN can be made using the respective application forms. These application forms can be downloaded or accessed through the websites of any of the government-approved agencies like NSDL or UTIITSL.

Indeed, even the Income Tax Department’s website may have links to these forms which can be utilized by individuals hoping to download or get to them.

Related: How to Link Aadhaar Card with PAN

PAN for Indian Citizens

When an Indian citizen has to pay taxes or perform any transaction that orders the use of PAN information at that stage, he/she needs to apply for a Permanent Account Number.

The application method for a fresh PAN consists of two basic sections originally filling out the application form and the second is the Income Tax Department’s shipment of the card.

PAN is also an essential proof of identification and is needed for various transactions such as bank deposits, mutual fund transactions, insurance purchases, and so on.

Online Pan Application

With the nation’s growing internet popularity and the associated simplicity and comfort of online banking, the Indian government is propelling online platforms for a ton of government facilities.

As mentioned earlier in this article two government-approved organizations NSDL and UTIITSL facilitate the online application portal for PAN. Both NSDL and UTIITSL are public organizations that complete distinct organizational functions other than managing the PAN application.

The online application is the most effortless method of acquiring PAN as this should be feasible for your turn from any region and without the issue of sitting tight in lines.

Online applications for PAN can be produced on the NSDL site and also on the UTIITSL site. Both have been endorsed by India’s govt to conduct PAN transactions for the advantage of the Income Tax Department.

The online procedure is the most problem-free technique to acquire PAN. The PAN applicant only needed to complete and submit the corresponding application form alongside the online payment of the corresponding processing fee.

In online application mode also there are two methods.

If we select an e-KYC/e-sign way, no need to submit the physical documents as our identity is verified by our Aadhaar number.

No copy of the application or the application form is required. Aadhaar must be connected to your mobile number. In this process, you will receive an OTP on your mobile device to complete the procedure.

You can grant PANs according to the Aadhaar database. The scanned image of the signature and the new photo in the specified format should be uploaded at this stage.

Related: How To Apply For Aadhaar Card Online

Otherwise, copies of the required documents could then be sent by post to either NSDL or UTIITSL for verification as instructed on the application page.

Offline Application of PAN

In addition to online platforms, the Income Tax Department has endorsed PAN centres across the country.

These facilities deal with PAN’s offline applications. You have to download the entity-based form 49A or 49AA and then bring a print of the same for the offline PAN application.

There are PAN centres in the nation’s major towns that deal with PAN’s offline applications. Anyone can approach these centres for PAN application-associated issues.

These facilities are suitable for those who do not have internet access. Normally rural and remote regions have low web accessibility for the most portion, and therefore these physical facilities for PAN applications work best in these places.

For people who are not precisely knowledgeable about using the internet, the primary option is the offline PAN application technique.

PAN for Foreigners

Online PAN applications for foreigners also follow equivalent rules for resident Indians, as the application form that should be filled out and presented in Form 49AA.

Foreigners holding a company or money-related exchanges in the country need to outfit PAN card details and consequently, the PAN card also transforms into a basic record for foreigners in India.

Every single foreign manager and people holding company positions as part of Indian affiliates need to have an Indian PAN paying little attention to their place (in or out of India).

Application for Changes/correction/modification/update in PAN Card Details

There are times when the incorrect input of entity information may be incorrectly printed on the PAN card or maybe wrongly entered in the Income Tax Department database. Any such variation in data can be corrected using the IT department’s correction and modification facility.

For women in India, there are times when they alter their name after marriage and there is a need for further proof of personality to be given. Such conditions also involve a change in PAN details and consequently, a fresh PAN with fresh card data is given to the applicant.

The application method for the correction of PAN details is like the one used to file a new PAN application. That is there is no separate PAN card correction form

This is because in either case, verification of address and identity are to be presented and another PAN card is to be issued by the tax department.

The points of interest that require correction should be verified using checkboxes given against each field.

Application for the Reprint of PAN Card

Reprinting PAN arises when someone loses his / her PAN card. This may happen due to burglary, misplacement, or any periodic catastrophe.

In such conditions, a PAN reprint request should be presented either with NSDL or with UTIITSL.

This same method can be followed for modification or correction of the PAN card details.

Reprinting of PAN requires your previous PAN card duplicate or affirmation duplicate as a reference source and confirms issuing a fresh PAN card to the applicant.

In this situation, only the issued card is new, while the details on the card are identical to before.

The application form for reprint or correction of PAN card is almost similar 49A form itself.

Be that as it may, since this is a reprint request for a current PAN, proof of (the PAN card, its duplicate or duplicate of the PAN acknowledgement letter should be submitted in the physical form to NSDL/UTIITSL).

Documents Required for Application of New/modified/reprint/correction of PAN

Documents needed for a wide variety of PAN applications mainly comprise those needed for evidence of address and confirmation of identity.

Apart from these basic records, proof of current PAN should be provided on the off chance that the applicant is applying for correction or reprint of PAN.

Similarly, two passport-sized photographs should be attached to the PAN application form.

If it is an online PAN application, a duplicate of the letter of affirmation should also be forwarded along with documents presented to the Department of Income Tax.

How to Track the PAN Card Application Status

Anyone applying for PAN is required to get the latest updates about their PAN application.

NSDL and UTIITSL have provided tracking of the same status. The reference number given for the completion of the application submission process can be used to track the status of your application.

If you don’t have the application acknowledgement number PAN status by name is also possible.

PAN card verification also be done in the respective portals.

When you apply for a fresh PAN or alter PAN information, the complete operation requires about 15-30 days to process your request and send a PAN card to your registered place.

During the holding period, however, you can track the status of your application by visiting any of the NSDL or UTIITSL sites and contributing your PAN application acknowledgement number.

Any kind of status request linked to the PAN application is free of charge.

While PAN requests produced to the NSDL can be followed through the acknowledgement number, those produced through UTIITSL can be followed through the division’s coupon number.

Status tracking remains up to date with the latest data about their application. Status can be followed merely after a particular time has elapsed since the submission of the PAN change or issue application form.

PAN Card Application Fees/charges

The charges imposed on the PAN application are very small. The fee differs from the type of application presented to the Department of Income Tax.

To get a PAN card with e-PAN, you have to pay Rs107 as a PAN card application fee. If you only want an e-PAN, you can pay only Rs 66. You may also use an e-pan as per your requirement.

Thus, charges for fresh PAN applications and PAN correction or reprint are varied. Thus, expenses are nominal for Indian citizens but more for NRI candidates and foreign applicants.

One aim behind this is how the office should dispatch a new PAN card whenever a request is made for modification reprinting or issuing. Postal fees are added to the applicant along these lines.

Related: How To Submit Online Passport Application?

The Difference in PAN Application Forms for NRI and Foreigners

NRIs are non-resident Indians and they require PAN to make any tax payment business in the nation.

Foreigners are foreign citizens who hold a business in an Indian venture and accordingly, they are required to furnish PAN.

As denoted earlier the PAN application forms for NRIs and foreigners are not similar.

In any case, the forms and application process are the same for NRIs and Indian residents.

This is mainly because the documents required and the expense charged is different for foreigners while it is the same for Indian nationals and non-resident Indians.

We hope you are interested in the article please share this informative article with your friends and relatives.

Subscribe to our free newsletter so that you will get similar articles and regular updates directly in your Email.

Also, consider following our Facebook and Twitter pages for regular updates.